Wealth Building Weekend

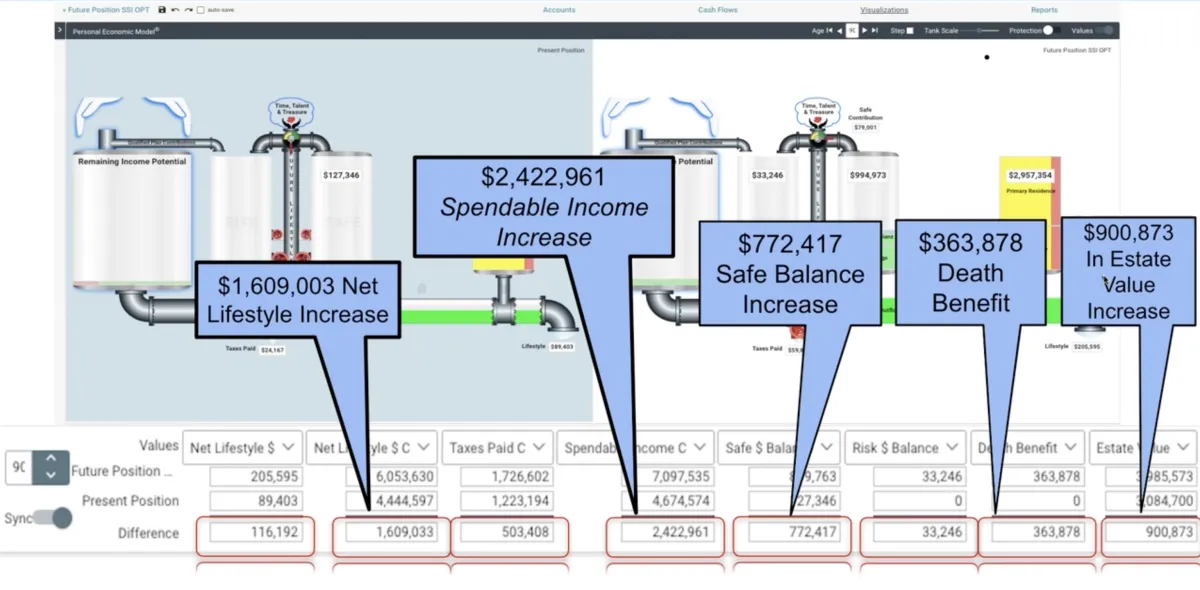

Let us show you how to increase your net-worth by a million dollars without lowering your current lifestyle standards and maximize your tax-free retirement income

Only 4 slots available in 2024 starting in September

Here's What's Included...

3 night stay in Jenn's condo in Cabo (Thursday - Sunday)

Airport pickup

Comprehensive financial analysis of present position

Consultation #1 to validate assumptions on present position

Consultation #2 to present recommendations

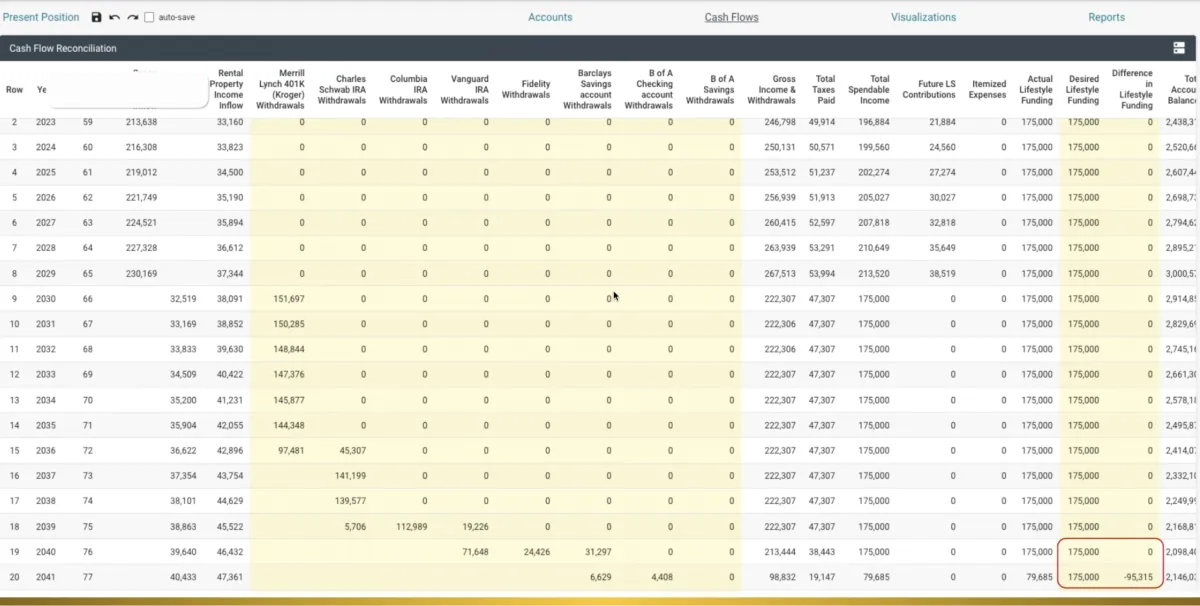

Report that answers the 4 most important financial questions (see example):

1) Do you know what rate of return you need to earn on the money you have today to be able to live in the future like you live today, adjusted for inflation, without running out of money before your life expectancy?2) Do you know how much you need to be saving on a monthly or annual basis to make sure you will have enough in the future for you to live like you live today adjusted for inflation?

3) Do you know how long you will have to work doing what you are doing now before you will be able to live on what you have accumulated and your money last to your life expectancy?

4) Do you know how much you will have to reduce your standard of living during retirement the future to keep your money from running out before your life expectancy?

Clarity on how you can grow your portfolio, earned & passive income

Here's How It Works...

Step 1: Watch the Thriving During Retirement Workshop Recording (25 minutes)

You will learn:

The 4 most important financial questions everyone serious about their financial future needs to know

Solutions that will help protect you against rising taxes, shield assets from market crashes, and secure retirement cash flow

What retirement account benefits to look for in order to maximize growth and future income

How to create a retirement plan that secures your retirement cash flow and insures you never run out of money

Step 2: Schedule a 20-Minute Introductory Meeting with Jenn so she can make sure you are a good fit, schedule your Wealth Building Weekend, and answer any questions regarding next steps.

Step 3: Process your payment for reserving your Wealth Building Weekend. This includes a 3-night stay in Jenn's condo, airport pickup, comprehensive financial analysis, financial consultations, and a report that answers the 4 most important financial questions.

Step 4: Submit your Confidential Financial Questionnaire so Merle can build your present financial position. This way you can visually see your current financial picture on one page.

Merle Gilley is a Retirement Planning Specialist with over 20 years experience. He lives in Virginia Beach on the water with his wife Monica, daughter Mia, and dog Max. When he is not serving clients, he enjoys spending time with his family and out on the Chesapeake Bay in his fishing boat.

Step 5: Hold a 1:1 Zoom meeting with Merle where he will validate the information to insure the present position assumptions are accurate.

Step 6: On Saturday morning in Cabo you will meet with Jenn in person and Merle via Zoom at the condo to review your revised future position recommendations. These recommendations will be focused on protecting you against rising taxes, shielding assets from market crashes, securing your retirement cash flow, and increasing your net-worth. You will be able to see your present vs. revised future financial position on one screen to see what is possible for you.

Qualifications

You are serious about your financial future

You are open to providing complete financial information for us to do a proper analysis of your present financial position

You are currently saving 10% of more of your annual income

You have $250K of assets accumulated

You have nothing to lose and so much to gain!

Investment: $750

Only 4 slots available in 2024 starting in September

Frequently Asked Questions

Can I see an example weekend itinerary?

Thursday

- Attend Art Walk from 6-9pm (condo is one block from the main plaza where this event is held)

Friday

- 8:00am Breakfast at Ruba's Bakery & Bistro

- 10:00am Meeting to discuss your financial recommendations

- 12:00pm Enjoy the Rooftop Pool at Condo

- Dinner at Osteria 107 across the street from the condo or any of the other nearby restaurants

- Walk around and explore San Jose

Saturday

- Breakfast at French Riviera

- Uber to Veleros Beach Club or El Ganzo and hang out at their rooftop pool

Sunday (optional)

Walk to Reserve Beach Club at Vidanta - get there at 11am to ensure you get a good cabana with an ocean view (only requires 1,000 peso minimum food & beverage spend which is less than $60 US) - click here for their Instagram

Can I hold both consultation meetings PRIOR to my Wealth Building Weekend so that weekend is free to just explore Cabo?

YES, we actually recommend this so you don't have to wait until you can make it down to Cabo. Jenn will still plan to meet up with you so we can all cheers together on the rooftop :)

Am I required to buy anything?

No, you don't have to make any changes if you don't want to. If you are interested in implementing any of the financial recommendations we just ask that be done through us. This does not cost you anything to do because we are paid by the financial companies that provide the indexed products.

How is this different than what my "Money Manager" is doing to manage my assets?

In the financial world there are two facets, those that specialize in the speculative facet, and those who specialize in the fixed facet. Rarely do you find an advisor that specializes in both. These really are two very different worlds. Those that specialize in speculative investing pride themselves in selecting publicly traded companies to place money in with the hope the investment will render a higher return over time than more predictable fixed investments. This philosophy or approach works well until there is an unforeseen economic correction. There is risk in speculative investing that is fine as long as the person doing the investing has ample time to make up for market corrections.

Those that specialize in the fixed investment world of finance eliminate risk associated with speculative investing. The perceived disadvantage to those interested in implementing safe fixed investments over speculative investments is the fear of missing out on the upside potential of the stock market gains. This is a misconception.

We specialize in working with fixed equity index products that emulate the upside potential of the stock market, without the downside risk. This sector of the financial industry has only been around for 25 years. Merle was an innovator in this market. He has served on three large companies advisory boards creating and improving these products over the past 20 years. There are very few financial professionals that understand how to use these products to benefit the client as well as Merle does.

Everyone who is serious about growing and protecting their money should have a portion of their money in a few equity index contracts. Using the right product, and the right company is important. Designing the product correctly to optimize the money is even more important.

Merle is an expert in analyzing people’s current financial position to make sure what you want to happen with your money does happen. Your money manager also probably has never answered the 4 most important financial questions for you:

1) Do you know what rate of return you need to earn on the money you have today to be able to live in the future like you live today, adjusted for inflation, without running out of money before your life expectancy?

2) Do you know how much you need to be saving on a monthly or annual basis to make sure you will have enough in the future for you to live like you live today adjusted for inflation?

3) Do you know how long you will have to work doing what you are doing now before you will be able to live on what you have accumulated and your money last to your life expectancy?

4) Do you know how much you will have to reduce your standard of living during retirement the future to keep your money from running out before your life expectancy?

Can I do a Wealth Building Weekend if I am retired and mainly interested in ensuring I will never run out of money?

Yes! Many of our clients are retired and just focused on ensuring their money and retirement income is fully optimized and secure.

In addition to learning how to optimize my portfolio income, can you also provide resources that help me increase my EARNED and PASSIVE income?

Yes! Jenn is a Co-Founder of the Rise & Thrive Club that offers many business building resources that will help you grow your earned and passive income. Selling your consulting packages, professional services, or group coaching program can help you grow your earned income. You can also sell digital products (courses, paid memberships, templates, etc.) to grow your passive income. All of your marketing, payments & product delivery can be done using the Rise & Thrive Funnels platform.